Overview

Fairfax India is an investment holding company that seeks to achieve long term capital appreciation by investing in public and private equities and debt instruments in India. The investment strategy of the company is to invest in ‘businesses that are expected to benefit from India’s pro-business political environment, its growing middle class and its demographic trends’. The investment operations are conducted by Fairfax (controlling interest) and Hamblin Watsa Investment Counsel Ltd. (a wholly-owned subsidiary of Fairfax), and investment advisory services are provided by Mumbai-based, Fairbridge Capital (a wholly-owned subsidiary of Fairfax).

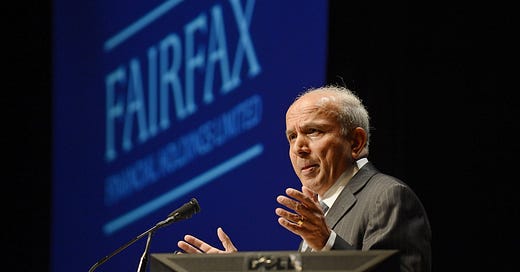

Fairfax India is managed by high-quality capital allocators, with strong long-term track records and a conservative, fundamental value-based approach. Most notable is Founder and Chairman, Prem Watsa, who has compounded Fairfax’s book value at ~19% from 1985 to 2019. Thus, Fairfax India presents investors with the opportunity to outsource a portion of their capital to an experienced group of capital allocators that have a deep knowledge of India and well-developed networks within the public and private markets. In fact, this is particularly valuable when considering the regulations and limitations imposed on foreign investors within India’s public equity markets (let alone their private equity markets!)

However, access to these private deals comes at a cost for shareholders because Fairfax India pays an investment and advisory fee and a performance fee to Fairfax. The investment and advisory fees are calculated and payable quarterly as 0.5% of the value of un-deployed capital and 1.5% of the company’s common shareholders’ equity. In addition, the performance fee is 20% of any increase in book value per share above a 5% per annum hurdle (includes a high-water mark). Undoubtedly, these are considerable fees, which creates a drag on returns, but this is the price for access to such opportunities. Moreover, the current risk-reward profile makes these fees less of a hindrance, but more on this later.

Investing in India

Ultimately, Fairfax India provides the opportunity to outsource capital allocation decisions to a group of experienced investors that have a deep-knowledge of India. Fairfax India provides exposure to hard-to-access markets within the fastest growing major economy in the world.

India is currently the 5th largest economy in the world and was one of the fastest-growing economies in the world in the decade prior to the pandemic; with the country growing annual GDP at ~7% on average. However, it appears this growth will continue for a considerable time. For example, the IMF predicts 9.5% growth in FY2021/22 and 8.5% growth in FY2022/23, with ~6% growth from 2023-2027.

India is witnessing a booming population and its population is ageing slowly; with a median age of 28.7 years. Moreover, it is predicted that over the next decade India will see 500 million people enter the middle-class, which will drive consumption spending up from $1.5 trillion to $5.7 trillion by 2030. Importantly, India still has 87% of the workforce working within agriculture, casual labour or self-employed jobs. Furthermore, India has a mere 20% female labor force participation rate (China: 60.6%). Thus, it is likely that if India plays to its strengths, it will witness an economic boom over the next several decades.

Of course, Fairfax India is seeking to benefit from these trends by opportunistically investing in the sectors that’ll benefit the greatest – such as infrastructure, financial institutions, consumer services, retail and exports.

Indian Investments

Fairfax India has a portfolio of high-quality public and private businesses across a broad range of sectors. However, the most significant investment is Bangalore International Airport – which is the best example of the exclusive private investment opportunities that are accessible to Fairfax India.

Fairfax India began acquiring Bangalore International Airport (BIAL) in 2017, acquiring a 54% stake in the company for $653 million (giving the entire company a valuation of $1.2 billion). BIAL is the third largest airport in India and the fastest growing airport in the world. Moreover, it is situated in the third largest and fastest growing city in India, which is considered India’s ‘Silicon Valley’.

Notably, BIAL has begun building a second terminal at the airport that’ll increase capacity from 30 million passengers to 70 million passengers by 2029. BIAL is also planning to build a third terminal that’ll increase capacity to 90 million passengers by 2034. In addition, BIAL has 460 acres of adjacent land that can be developed to meet the demands of the rapidly growing and congested city – something the company is now aiming to monetise. Thus, the growth prospects for this company are incredibly high.

In the third quarter of 2021, Fairfax India transferred 43.6% of its 54% equity interest in BIAL into its subsidiary Anchorage Infrastructure Investments Holdings, which is the company’s flagship investment vehicle for infrastructure investments in India. Importantly, Fairfax India has sold 11.5% of Anchorage for $130 million to OMERS, which consequently values 100% of BIAL at $2.6 billion. Thus, based on Fairfax India’s 49% effective ownership, the investment is now valued at $1.37 billion.

Currently, Fairfax India trades at a market capitalisation of $1.71 billion, meaning at current prices, you can purchase a stake in the world’s fastest growing airport, whilst acquiring an outstanding collection of additional businesses for next to nothing. Of course, it could be argued that Fairfax India has inaccurately estimated the value of BIAL and hence the company is not as cheap as it appears. However, Fairfax India believes their valuation estimates of BIAL are actually very conservative and Prem Watsa said that “if you look at Shanghai, it's trading in excess of USD 20 billion. So this is trading at $3 billion. And it's a long ways off from Shanghai. I understand that. But this is a private airport. It's really well run. And it's in the third-largest city in India”. So, it asks the question: how much would investors be willing to pay for BIAL in the public markets?

Fortunately, we will shortly find out because Fairfax India intends to IPO Anchorage, at a valuation that’ll value 100% of BIAL at $2.9 billion. Fairfax India believes the marketability of BIAL and the demand for such an asset could help unlock the true value of BIAL – which they believe is much higher than $2.9 million.

Interestingly, Sydney Airport is delisting next week after a $17.5 billion takeover bid from ‘Sydney Aviation Alliance’ was accepted. The acquisition values Sydney Airport at 25x 2023 EBITDA and 15x 2023 revenue. BIAL is a private company and only has minimal financial reporting, which can be found on their website and the Airports Economic Regulatory Authority of India website. Nonetheless, Fairfax India expects passenger traffic at BIAL to recover to pre-pandemic levels by 2023. Thus, despite BIAL being private, we can use its 2018 pre-pandemic revenue of $234 million as a rough estimate. Therefore, at a current valuation of $2.6 billion, BIAL is valued at approximately 11x pre-pandemic revenue. However, this doesn’t account for the tripling of passenger capacity in the next decade nor the 460 acres of land that will be monetised in the coming years. So, it’s a rough yardstick, but it could be argued that Fairfax India is conservatively valuing BIAL.

Nonetheless, BIAL only accounts for ~40% of the total investment portfolio – there’s an additional collection of public and private Indian investments estimated at $2.14 billion (as of 30th September). For example, Fairfax India also owns 42.9% of Sanmar Chemicals Group, which is one of the largest PVC manufacturers in India. In addition, the company owns several financial companies such as one of the oldest private sector banks in India, CSB Bank (49.7% ownership), and IIFL Wealth (13.8% ownership), which is a highly successful wealth management business operating within the niche ultra-high net-worth individual (UHNI) segment.

In addition, the company also owns fantastic assets such as a 1% ownership in the National Stock Exchange of India and a 48.5% ownership in Seven Islands Shipping, the second largest private tanker shipping company in India, which has grown EBITDA at a 30% CAGR over the last 10 years. Essentially, Fairfax India is building a collection of high-quality, industry-leading businesses with strong competitive advantages that are going to benefit significantly from the economic growth that will ensue in India.

Valuation

Currently, BVPS stands at $20.37, whilst the current share price is $12.00, meaning a ~41% discount to BVPS. Therefore, at Fairfax India’s current price, there is a significant margin of safety imbedded into the valuation. Moreover, Fairfax India will soon have greater transparency when a significant portion of their private investments IPO in coming years – bringing the proportion of the market value of publicly listed investments up from 31% to 90%. Thus, the greater transparency will most likely be a catalyst for the re-rating of their share price to valuations more in-line with BVPS.

Fairfax India have been quite vocal in their acknowledgment of the considerable discount and in August completed a substantial issuer bid, which saw them purchase 4.7% of shares for $105 million at an average purchase price of $14.90. Moreover, in September Fairfax India also announced intention to make a normal course issuer bid that will allow the company to purchase 3,500,000 shares, representing approximately 5.1% of Fairfax India’s public float.

So, Fairfax India is experiencing both strong underlying growth in BV, whilst also buying back a substantial portion of their shares at a steep discount to BV – a good combination. Overall, I believe the substantial margin of safety embedded in the valuation, coupled with large buybacks and a near-term IPO of Anchorage, could provide the catalysts necessary to propel the stock price significantly higher.