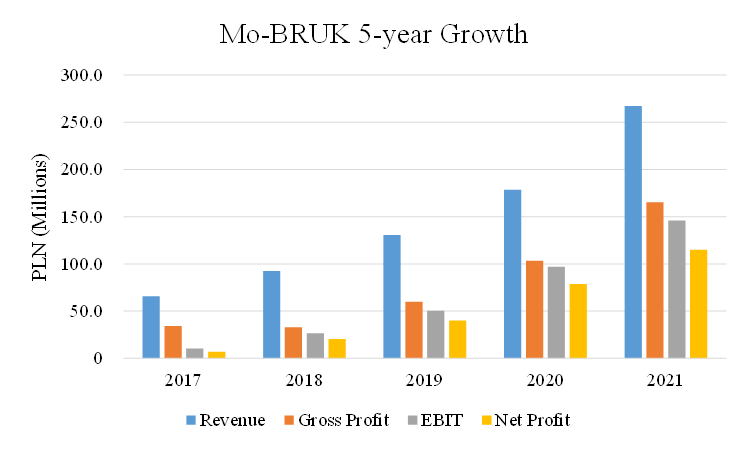

Mo-BRUK S.A. (MBR) is an under-the-radar, industry leading waste processor, based in Poland. Due to significant policy changes within Europe and Poland, the waste management industry has undergone serious change, which has resulted in increasingly eco-friendly attitudes. As a result, Poland has begun more extensively promoting the recycling and recovery of waste, versus storing waste in landfill. This new focus on limiting the use of landfill has resulted in a massive decline in the grey market, which was artificially lowering prices. Consequently, demand for Mo-BRUK’s recycling services has increased dramatically. Since 2017, earnings have grown at a 75.6% CAGR and operating margins have expanded by 39 percentage points (2021: 55%). Mo-BRUK’s outlook appears strong, the company is recession resistant, and due to the heavily-regulated nature of waste management, the company has built up a sustainable position as the market leader. In addition, the valuation is undemanding at a current earnings yield of 10.9%.

Business Overview

Mo-BRUK is the leading industrial waste processor in Poland. The company runs five waste disposal facilities in southern Poland and operates in three complementary areas of waste management: incineration of industrial and medical waste, solidification and stabilisation of waste, and production of refuse-derived fuel.

1. Solidification and stabilisation of inorganic waste (S&S) is the treatment and cementation of inorganic hazardous waste, such as slags and ashes from municipal incineration plants, sludge from chemical treatment plants and other waste containing heavy metals and acids. Mo-BRUK collects a fee from waste producers for the cementation of hazardous waste and sells the granulated cement to end customers for use in road construction and land reclamation.

2. Incineration of hazardous and medical waste is a particularly favourable form of waste treatment because the high temperatures destroy pathogens and toxins. Moreover, the heat produced by the incineration plants can be used to dry refuse-derived fuel at the company’s alternative fuel facilities.

3. Refuse-derived fuel (RDF) is produced from combustible municipal and industrial waste supplied by waste collectors and industrial plants. The accepted waste is mechanically processed and turned into refuse-derived fuel, which is a substitute for fossil fuels. The RDF is delivered to cement plants and Mo-BRUK pays the ‘buyer’ for the fuel delivered. Despite this arrangement, Mo-BRUK still generates solid margins due to the fees received for accepting waste from municipal collectors and industrial plants.

In essence, the company charges a fee for accepting waste from waste producers. Mo-BRUK then processes that waste and produces: granulated cement, energy and fuel. Ultimately, Mo-BRUK is an alternative to landfill, which makes it an increasingly important part of the waste management chain in Poland.

The fees charged for the acceptance of waste vary depending on waste category. In recent years, the fees charged across all segments has grown considerably, with fees growing 24%, 368% and 285%, respectively across the abovementioned business segments.

Essentially, in an attempt to diminish the attractiveness of landfill, Poland has been materially increasing the marshal fee (landfill tax). In fact, Poland has had the fastest growing waste disposal fee in the EU for the last two years. Consequently, as the price of landfill goes up, so too does the attractiveness of its alternatives. As a result, Mo-BRUK has been increasing waste acceptance fees in-line with the updated market prices, whilst unit costs have remained unchanged (or reduced due to better efficiency at higher capacity levels). Consequently, as prices and volumes have increased, the profitability of the business has likewise, with net margins improving from 10.5% in 2017 to 43% in 2021.

Industry Overview

Historically, Poland has had awfully relaxed environmental regulations, which made the country a dumping ground for a lot of Europe’s unwanted waste. In fact, Poland has often been referred to as the ‘European China’. Poland had a large informal waste sector, known as the grey market, which had been operating illegal landfill sites and artificially lowering prices. This environment was particularly challenging for Mo-BRUK as they could not effectively compete with these cheap alternatives. However, after a series of these illegal landfill sites caught fire and emitted hazardous fumes across Poland, public uproar ensued and the government introduced legislative packages preventing the uncontrolled importation and storage of waste. The Environment Minister stated: “we cannot allow Poland to become an illegal waste dump for Europe”.

In 2018, Poland relied on landfill for 42% of its waste disposal, whilst the European average stood at around ~23%. However, this is now changing due to the European Unions updated circular economy package, which has resulted in a new climate policy being introduced. The EU has set all its member states a goal of recycling at least 60% of municipal waste by 2030, and by 2035, only 10% of municipal waste can be dumped into landfill. Thus, Poland now has a twofold reason to reduce its reliance on landfill and increase its recycling.

As mentioned, these above factors have caused the government to systematically increase the marshal fee, in order to reduce its dependence on landfill and increase demand for recycling. Consequently, the waste management market in Poland is experiencing a period of major change, and the company benefiting the most is Mo-BRUK.

Opportunity

The industry tailwinds outlined have resulted in significant growth for the business but the opportunity to target new business and increase volumes remains massive. In fact, Mo-BRUK is already anticipating volume growth across the board and plans to add additional capacity in the coming decade, both organically and via acquisitions.

Solidification & Stabilisation

S&S receives a majority of its waste from municipal incineration plants, which it subsequently turns into granulated cement. Currently, S&S runs at 80% capacity utilisation and processes 136,000 tonnes of waste per annum. However, there will be a considerable increase in volume in the coming years because presently, 50% of all household waste in Poland is landfilled, but by 2030 that number has to fall to 0% (due to EU legislation). Currently, Poland has nine municipal incineration plants (different from hazardous and medical incinerators) producing 275,000 tonnes of slag and ash per annum, but it will almost double that supply when the construction of seven new municipal incineration plants is completed. Thus, Mo-BRUK has plans to invest approximately PLN 80 million, which will add 140,000 tonnes of additional capacity by 2023. This massive increase in supply should be a significant growth driver for the company in the coming years and will grow the significance of S&S within the company; which currently accounts for 52% of volumes.

Incineration

Interestingly, Poland has a population of 38 million and a hazardous waste incineration capacity of 0.1 million tons, versus Germany, with 1 million tons of capacity for a population of approximately 80 million. So, there is a significant lack of processing capacity in relation to the needs of the hazardous and medical waste market. However, supply isn’t increasing. In fact, hazardous incineration plants are being taken out of operation, due to non-compliance with emission standards and there are no new hazardous waste incineration plants currently being built. Mo-BRUK reportedly has 35% of total capacity, but this is actually understating it, due to a lot of capacity being owned by hospitals and oil refineries – which are run on a non-commercial basis. So, Mo-BRUK has a substantial market share and only six other smaller hazardous incineration plants are currently run commercially.

Incineration is the most profitable of the three segments with gate fees considerably higher at PLN 3356/t (2020); which is due to the supply shortage (plus the clean-up of illegal landfill). Nevertheless, it’s not an easy market to enter due to the tedious process of obtaining the appropriate permits and planning permission, which takes multiple years (3-5 years). It’s a strictly governed market and it’s also a business centred on burning hazardous waste, so building new plants is very hard because no one wants hazardous waste being incinerated near them! As a result, Mo-BRUK is facing limited competition and intends to meet the market shortage by adding an additional 8,000 tons of incineration capacity by 2023.

Ecological Bombs

However, the biggest opportunity is undoubtedly the clean-up of ‘ecological bombs’. Whilst Poland is trying to redeem itself for its prior bad habits, the remnants of its prior relaxed environmental laws can be seen across the country. It is estimated there are ~800 ‘ecological bombs’ across Poland with a combined 4.5 million tonnes of abandoned hazardous waste. Essentially, these are illegal landfill sites filled with asbestos, solvents and oils imported from countries such as Germany. They are major threat to the surrounding environment and the improper handling of these sites can have devastating consequences.

Mo-BRUK has PLN 106 million in contracted revenue for the clean-up of 15,700 tonnes of hazardous waste across twelve ‘ecological bomb’ sites, at an average price exceeding PLN 6000/t. The profitability of this business is predominately due to two factors. Firstly, Poland views this as an immediate issue and has been assisting local governments with funding through the ‘National Fund for Environmental Protection and Water Management’. Secondly, it’s a specialised business that requires difficult-to-obtain permits and also the confidence of local governments because there’s a limited number of companies that can safely remove this type of waste. So, it’s a recipe for success - price inelastic local governments and a limited bidding pool.

Mo-BRUK estimates this is a PLN 15 billion (€3.2 billion) domestic market and the clean-up is estimated to take ten years. However, the company currently only has 5,000 tonnes of annual capacity, which suggests either Mo-BRUK intends to significantly ramp-up capacity or the opportunity will last a lot longer than ten years.

Railway Sleepers

Mo-BRUK is also adding capacity for the processing of railway sleepers. It’s estimated that 25% of existing railway sleepers (21 million units) in Poland are past their useful life, which amounts to over 1.7 million tonnes of sleepers available for disposal. Consequently. Mo-BRUK calculates it could be supplied with 30 years’ worth of softwood and hardwood, which is perfect for producing alternative fuel.

Interestingly, railway sleepers are classified as hazardous waste, meaning prices for disposal have been twice the typical rates accepted in RDF. So, there’s a large opportunity to fill the 61% of un-utilised capacity in RDF and Mo-BRUK has already adapted their RDF facility in Wałbrzych (60,000 tonnes) to process railway sleepers.

Overall, Mo-BRUK has multiple opportunities within each segment of the business that will provide strong future growth and improved profitability.

Business Quality

Mo-BRUK looks almost un-identical from five years ago. In 2017, it did PLN 65.6 million in revenue, with 11% net margins. It operated in an environment dominated by the grey market, where alternatives to landfill weren’t even given a look-in and Mo-BRUK had to be very cost conscious. However, in 2021, Mo-BRUK reported revenue of PLN 267.2 million (~4x increase in revenue), with 43% net margins (~50% excluding legal fees) and paid out the vast majority of earnings. So what’s changed?

As mentioned, the business collects a fee for accepting waste. In the last five years, that fee has risen considerably across all segments of the business due to policy changes both in Poland and Europe – most notably the marshal fee. Consequently, as the attractiveness of Mo-BRUK’s services has increased, revenue has likewise increased; growing at a 32.4% CAGR. In contrast, volumes have grown at a 9% CAGR. So, the transformation of the business has almost entirely been a result of prices changing within the waste management industry.

The change in price dynamics has notably effected the profitability of the business because whilst revenue has grown considerably, operating expenses have only increased at half the rate. Hence, the business is charging more for accepting waste but the fixed costs have remained almost unchanged, which is leading to significantly improved profitability.

In addition, Mo-BRUK invested approximately PLN 200 million into the business during the last decade, which resulted in a major increase in capacity. This is due to several investments such as, the construction of a waste recovery plant in Skarbimierz, and a hazardous waste incineration plant in Karsy. Consequently, Mo-BRUK now has the capacity necessary to meet the demands of the growing market without having to incur any major investments for the foreseeable future. As a result, capital expenditure requirements are small and largely consist of maintenance capital expenditures, such as the replacement of equipment. This allows the business to generate high levels of free cash flow, which the business can distribute to shareholders or use to make strategic acquisitions.

In 2021, Mo-BRUK had almost no debt and produced a 55.6% ROE (not excluding significant excess cash), versus a 7.6% ROE in 2017. Of course, the business returns are fantastic but just five years ago this wasn’t the case, so is this a temporary blip or the new status quo? It could be assumed that with such high returns, competition will quickly enter the market, increase supply and compete excess returns away. However, there are some barriers to entry preventing this from being the case.

As mentioned, there are currently no hazardous incineration plants being built in Poland, which is perhaps a telling sign that barriers to entry exist. The waste management sector in Poland is heavily regulated and doing business requires several permits at both the state and district level, which can take multiple years to acquire if successful (which isn’t a guarantee). Thus, it’s not necessarily an appealing industry for prospective new entrants due to this risk.

Moreover, there is also the risk of not obtaining planning permission for new facilities. For example, Mo-BRUK’s solidification and stabilisation plant in Niecew has been in operation since 1997, but when the company announced plans to slightly expand the facility in 2021, it received local outrage. The local community protested the plans and wrote letters to the company complaining that the noise, dust and unpleasant smells were causing local residents to have headaches and sore throats. This is the difficulty Mo-BRUK is having when trying to expand an existing plant that’s over two decades old. New entrants will have a much harder time convincing residents to allow them to put a loud and foul-smelling hazardous waste plant on their doorstep. Nobody wants that being built near them!

Also, whilst barriers to entry are a problem, there is also the issue of building a reputation, which is especially necessary when bidding for contracts. As mentioned, the clean-up of illegal landfill is the most lucrative business opportunity, with prices often exceeding 9000 PLN/t. However, it’s also a business that requires not only specific permits but also the confidence of local governments. To give an example, one alkaline battery can contaminate 167,000 litres of water. So, imagine the devastating consequences that mishandling 5,000 tonnes of hazardous and medical waste could have on the environment. Therefore, local governments are very careful with who they trust to safely handle this waste. In addition, Poland is also determined to remove the image of them as Europe’s ‘illegal waste dump’. Thus, they’re fairly price inelastic and will pay what’s necessary to remove these ‘ecological bombs’ as quickly and safely as possible. Consequently, as Mo-BRUK is one of the only companies with both the appropriate permits, experience and reputation, their position within this market is very strong.

Valuation

At the current share price of PLN 305, Mo-BRUK has a market capitalisation of PLN 1.1 billion (€236 million) and an enterprise value of PLN 922 million. In 2021, Mo-BRUK produced EBIT of PLN 145.9 million and net income of PLN 115 million. Thus, at current prices, Mo-BRUK trades at a 15.8% pre-tax trailing earnings yield or a 10.9% trailing earnings yield. In addition, due to the low capital intensity of the business the vast majority of earnings are paid out in dividends, which means the company currently trades at a 10.3% trailing dividend yield.

Whichever metric you look at, Mo-BRUK trades at very low multiples, especially considering the business earns a 55.6% ROE and has really strong growth prospects across all segments of the business. However, even before considering the current growth prospects, the shareholder yield is already >10%. Therefore, considering this is a recession resistant business, that plays an important part in the waste management chain, it’s hard to argue it’s not a fundamentally cheap company.

Nevertheless, you never find anything cheap for no reason. Part of the reason the opportunity exists is because there are uncertainties surroundings the company. However, there is also a portion that can be explained by the fact that Mo-BRUK remains a difficult company to follow because of language barriers and lack of coverage, due to a general hesitation amongst institutions to invest in developing countries. However, Mo-BRUK’s recent inclusion into the mWIG40 Index should help improve this. Overall, it remains an under-the-radar business and hence explains part of the reason it’s so cheap - but if these factors change and its coverage improves, or institutional investors jump on-board, then price appreciation can follow in abundance.

Risks

A more recent uncertainty surrounding the company has been the considerable fees placed on them by the Marshal of the Lower Silesian Voivodeship for the improper storage of waste at the landfill site in Górnicza 1 in Wałbrzych. The fees are considerable and amount to PLN 69 million for waste storage in 2019 and PLN 105 million in 2020, as well as fees for 2016, 2017 and 2018, which they’ve had reduced. Mo-BRUK has a history of having fees imposed on them that are later reduced. For example, in a similar instance back in 2016, Mo-BRUK had a fee imposed by the Marshal of the Dolnośląskie Voivodeship, which was re-examined and subsequently reduced from PLN 6,084,016 to a small fee of PLN 807. So, the current fees imposed on the company shouldn’t be considered final. In fact, management has indicated there’s a high likelihood that the fees are either reduced or completely revoked.

Moreover, it should be noted that Mo-BRUK doesn’t appear particularly popular in Wałbrzych. In 2015, the President of the City of Wałbrzych publicly stated that Mo-BRUK’s operations in Wałbrzych should be suspended because the activity of the company caused "a significant reduction in the quality of water, air or land surface and destruction in the plant or animal world to a large extent". Of course, Mo-BRUK had tests carried out by authorized entities, which “undoubtedly indicated that there was no air contamination”. However, the President also claimed the landfill had leaked causing an ecological bomb in ul. St. Joseph. Again, Mo-BRUK disproved this and had an independent, accredited external laboratory do a chemical analysis. Furthermore, in another instance in 2011, it appears that the Lower Silesian Voivode denied or removed Mo-BRUK’s integrated permit to run installations located in Wałbrzych at ul. Górnicza 1 and 4. However, the decision was revoked by the Provincial Administrative Court in Warsaw. The court stated that there was no such breach and correctly issued a decision on granting Mo-BRUK an integrated permit. Mo-BRUK stated it was “another judgment of the court pointing to the wrong actions of the authorities”. Clearly, Mo-BRUK has been fighting legal battles in Wałbrzych for a while.

In addition, a main risk that Mo-BRUK could face is regulations loosening. As mentioned, the process of obtaining the correct permits and seeking planning approval often takes 3-5 years. However, if regulators decide to relax regulations to attract new entrants then Mo-BRUK will witness increased competition in the industry, which will push prices down.

Alternatively, the recent trends towards increased recycling in Poland could change and the government could decide to reduce the prices for landfill which will negatively impact Mo-BRUK. Poland’s waste prices are high relative to other European countries but still in the range of normality, plus the country has had a major shadow economy problem, so prices don’t appear excessive. Nevertheless, the marshal fee is an important figure to track and it can impact Mo-BRUK’s business considerably, both on the upside and downside.

Furthermore, another point of interest is the recent change of president of the company. Józef Mokrzycki, who founded the business in 1985, has decided to step down. It is strange timing considering the recent success and clear path for growth ahead but perhaps he has taken the company as far as he believes he can and is now passing on the baton for the company’s next chapter (purely speculation). Nevertheless, Mo-BRUK is now entering a period of new leadership and with that comes uncertainty.